45l tax credit form

The 45L Tax Credit offers 2000 per dwelling unit to developers of energy efficient apartment buildings and homes in the state of Texas. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home.

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

Streamlined Document Workflows for Any Industry.

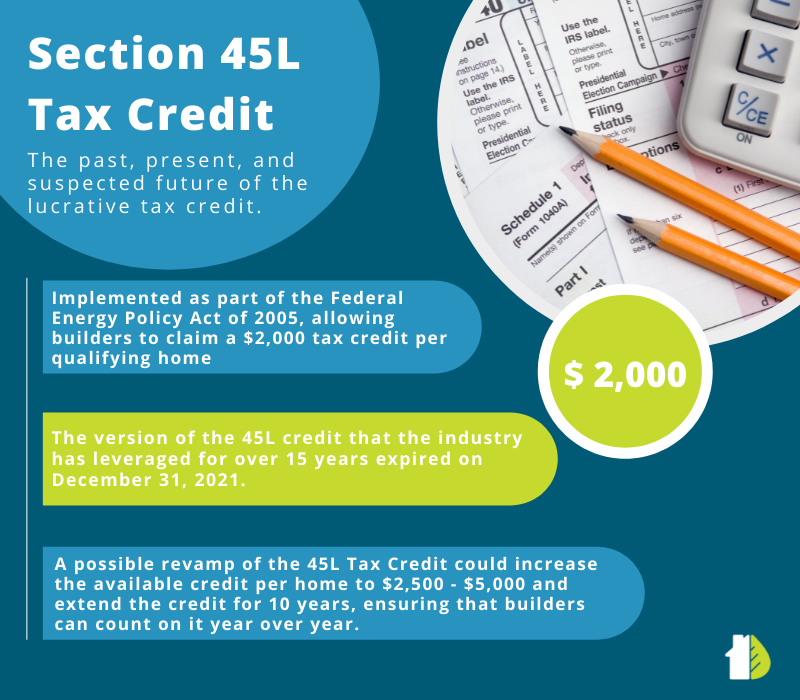

. The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of new energy-efficient homes. The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in. To claim the 45L tax credit the property must meet the following criteria.

Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit. All property tax relief program information provided here is based on current law and is subject to change. An Arkansas Home Builder who sold 35 homes in 2021 qualified for 70000 in 45L.

There is no separate Schedule A for the MCTMT in this example since there is no excess of the New York. Are then added to determine the total credits for taxes paid to other jurisdictions. Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. The fundamentals of the 45L credit have not changed. For qualified new energy efficient homes other than manufactured homes.

We model every new home in the most cost effective energy efficient way. Units homes leased up or sold in an open tax year generally the last 3 years. 133 was signed into law which extended the 45L Energy Efficient Home Tax Credit to include any new qualified.

2 Form Any certification described in subsection c shall be made in writing in a manner which specifies in readily verifiable fashion the energy efficient building envelope. The 45L credit permits eligible contractors or developers to claim a tax credit when building a qualified dwelling or home. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications.

The tax credit was retroactively extended from. Enter total energy efficient home. As part of the New Energy Efficient Home Tax Credit under Code Section 45L a 1000 credit is also available for an eligible contractor with respect to a manufactured home.

27 2020 the Consolidated Appropriations Act 2021 HR. See section 45L for more information. 45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction.

Arkansas Home Performance has processed over 240K in 45L Tax Certificates in 2022 including. The 45L tax credit is an incentive given to developers of homes and apartment buildings that are deemed to be energy efficient. Find Forms for Your Industry in Minutes.

Ad State-specific Legal Forms Form Packages for Government Services. You are eligible for a property tax deduction or a property tax credit. The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by.

It offers a generous 2000 per dwelling unit to projects whose. Eligible contractors use Form 8908 to. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

The 45L Tax Credit originally made effective on 112006. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement.

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

This Represents Ambiguous Because It S Unclear On Which Way You Can Go Ambiguity Vocab Tech Company Logos

Biden S 2022 Tax Proposals Bolster The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

Section 45l Energy Tax Credit Past Present And Future Ekotrope

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Ambiguous This Pictures Has Two Meanings One Is Someone Riding A Bike And Second Is A Girl Bike Ride Art Picture

This Represents Sporadic Because The Chart Numbers Are Going Up And Down Like Crazy Vocab Vocabulary Facetime

This Represents Inadvertent Because The Waiter Is Too Busy Looking At The Woman That He Accidentally Spills The Food On The Man Vocab Chapter Chapter 3